Media

AFR Smart Investor: How to buy over the border?

Investors from Sydney and Melbourne are increasingly looking further afield in the hunt for value. But how do you go about buying in an unfamiliar market?

Feature AUSTRALIAN FINANCIAL REVIEW – SMART INVESTOR!

This Super Saturday & Sunday. We are honored to grace the front page of the Smart Investor section in the Australian Financial Review Financial Review for the weekend edition! (4th – 5th May 2024) This is a game changer for us!

THANK YOU Alex & Megan De Muelenaere and ALL my clients who have entrusted us at Inspire Realty with your property portfolios and to help search, research and select the best property for you. Thank you Michelle Bowes for your articulate article and for this amazing write up!

We are grateful and glad to help with stewarding our clients generational wealth for a better future together! It has been a real pleasure, privilege and purpose filled journey for us.

Why this Sydney investor bought property in Brisbane

Investors from Sydney and Melbourne are increasingly looking further afield in the hunt for value. But how do you go about buying in an unfamiliar market?

When looking to buy an investment property, Sydney homeowner Alex De Muelenaere didn’t consider buying in his own backyard. Instead, the 35-year-old CFO of emissions accounting business Pathzero looked north, recently settling on the purchase of his first investment property – in Brisbane.

De Muelenaere is among a new wave of Sydney and Melbourne investors eschewing their home states to invest further afield. He says strong interstate migration, the relative affordability of property and the capital growth tailwinds expected to accompany the 2032 Olympics were the key drawcards of the Queensland capital.

With a focus on capital growth over yield, he bought a four-bedroom, two-bathroom house in the coastal suburb of Thornlands, around 45 minutes south-east of the CBD, for $920,000, with the assistance of Brisbane buyer’s agent Colin Lee, founder and chief executive of Inspire Realty.

De Muelenaere says using Lee gave him local expertise in an unfamiliar market as well as “boots on the ground”. As a result, he was aware the property was for sale before it was listed and was able to secure it – all without leaving Sydney.

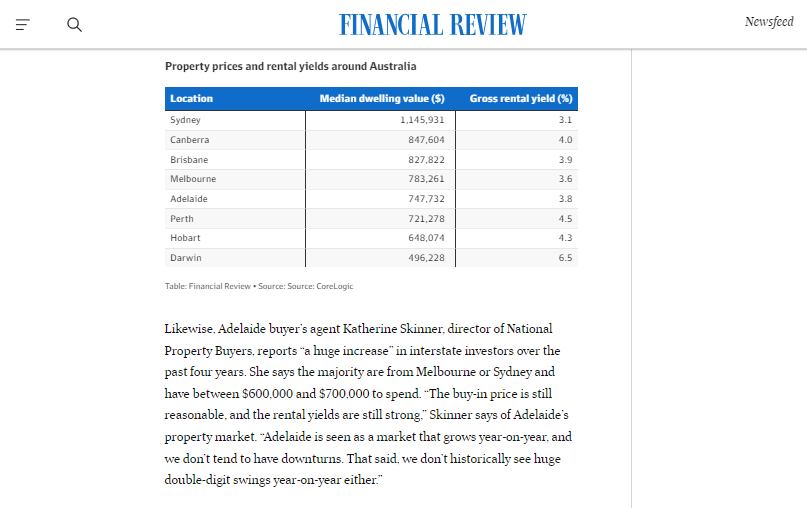

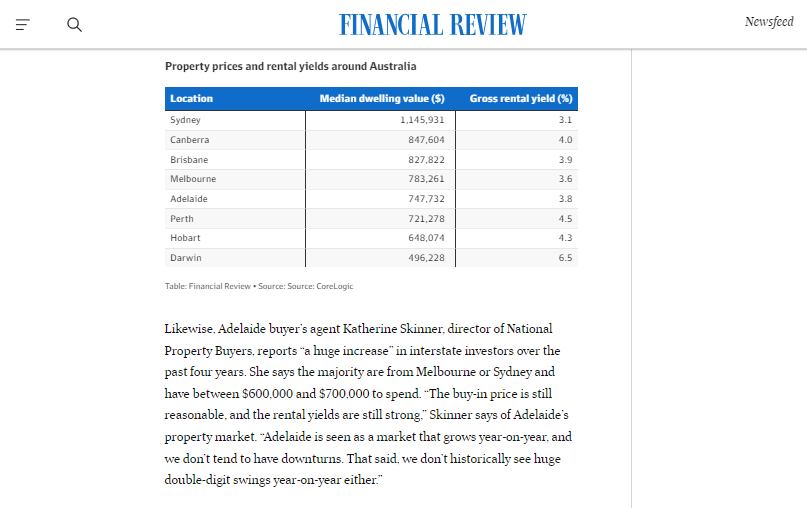

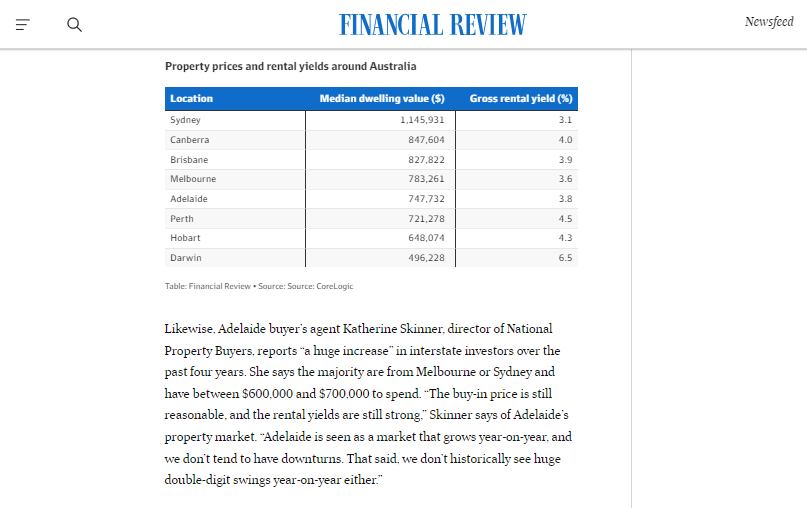

With the median dwelling price in Sydney hitting $1.15 million in April and Melbourne’s investor appeal suffering under the weight of some of the highest property taxes in Australia, investors from Australia’s two biggest states are casting their eyes elsewhere.

Data from REA Group shows 23 per cent of all property inquiries on realestate.com.au came from interstate buyers in 2023, a figure that has been rising steadily recently after hitting a low of 11 per cent during the pandemic. South Australia and Queensland attracted the highest amount of interstate interest, with 29 per cent and 27 per cent of inquiries coming from interstate buyers, respectively, followed by Western Australia.

Lee says that more than 90 per cent of his clients looking to buy in Brisbane are from interstate. “The fact that Brisbane has been outperforming all capital cities bar Perth is a really good story,” he says. “There’s obviously a lot of talk around the Brisbane market having not only the Olympics, but the emergence of more employment because of that. Plus, there are a lot more migrants – not only interstate but international migrants moving to Queensland.”

When looking to buy an investment property, Sydney homeowner Alex De Muelenaere didn’t consider buying in his own backyard. Instead, the 35-year-old CFO of emissions accounting business Pathzero looked north, recently settling on the purchase of his first investment property – in Brisbane.

De Muelenaere is among a new wave of Sydney and Melbourne investors eschewing their home states to invest further afield. He says strong interstate migration, the relative affordability of property and the capital growth tailwinds expected to accompany the 2032 Olympics were the key drawcards of the Queensland capital.

Hornsby resident Alex De Muelenaere lives in Sydney but looked north to Brisbane for an investment property. Oscar Colman

With a focus on capital growth over yield, he bought a four-bedroom, two-bathroom house in the coastal suburb of Thornlands, around 45 minutes south-east of the CBD, for $920,000, with the assistance of Brisbane buyer’s agent Colin Lee, founder and chief executive of Inspire Realty.

De Muelenaere says using Lee gave him local expertise in an unfamiliar market as well as “boots on the ground”. As a result, he was aware the property was for sale before it was listed and was able to secure it – all without leaving Sydney.

With the median dwelling price in Sydney hitting $1.15 million in April and Melbourne’s investor appeal suffering under the weight of some of the highest property taxes in Australia, investors from Australia’s two biggest states are casting their eyes elsewhere.

Data from REA Group shows 23 per cent of all property inquiries on realestate.com.au came from interstate buyers in 2023, a figure that has been rising steadily recently after hitting a low of 11 per cent during the pandemic. South Australia and Queensland attracted the highest amount of interstate interest, with 29 per cent and 27 per cent of inquiries coming from interstate buyers, respectively, followed by Western Australia.

Lee says that more than 90 per cent of his clients looking to buy in Brisbane are from interstate. “The fact that Brisbane has been outperforming all capital cities bar Perth is a really good story,” he says. “There’s obviously a lot of talk around the Brisbane market having not only the Olympics, but the emergence of more employment because of that. Plus, there are a lot more migrants – not only interstate but international migrants moving to Queensland.”

Likewise, Adelaide buyer’s agent Katherine Skinner, director of National Property Buyers, reports “a huge increase” in interstate investors over the past four years. She says the majority are from Melbourne or Sydney and have between $600,000 and $700,000 to spend. “The buy-in price is still reasonable, and the rental yields are still strong,” Skinner says of Adelaide’s property market. “Adelaide is seen as a market that grows year-on-year, and we don’t tend to have downturns. That said, we don’t historically see huge double-digit swings year-on-year either.”

Real estate agent Linton Allen, from Perth’s Empire Property, has also observed a “noticeable uptick in interest from interstate investors, particularly from Sydney and Melbourne”. Alongside its comparative affordability, Perth “offers robust rental yields, making it an attractive option for cash-flow-focused investors”. Historically subject to the fortunes of the mining industry, the Perth real estate market is benefiting from government investment as part of the AUKUS submarine pact and Allen says the diversifying economy means there’s a “growing optimism around capital growth prospects”.

Herron Todd White’s April Month in Review report suggests that both house and unit prices across Brisbane, Adelaide and Perth have further to rise.

Location, location, location

Picking the right location in an unfamiliar market can be challenging. As with any property investment, the starting point should be the outcome an investor wants to achieve.

“Investors should start with clear goals: are they seeking capital growth, rental yield, or a balance of both?” Allen says. Lee says another factor to consider is the buyer’s appetite for renovation to add value or whether they prefer a “set and forget” property. Skinner encourages her clients not to focus solely on rental yield because if they do, they “tend to sacrifice capital growth in many areas within South Australia”.

Locations close to amenities with a high ratio of owner-occupiers to renters and below-average rental vacancies are a good place to start.

Lee’s top picks in Brisbane for investors with less than $1 million to spend are Flinders View, Shailer Park and Aspley. For those with a budget of more than $1 million, he tips Carindale, Wavell Heights or Balmoral.

In Adelaide, Skinner recommends Royal Park, Albert Park, Happy Valley and Aberfoyle Park for investors on smaller budgets and blue-chip suburbs such as Prospect, Norwood, Kensington or Unley for those with a budget of $1 million-plus.

In Perth, Allen says buyers will get more bang for their buck by heading inland away from the river or coast. He picks Hamilton Hill and Spearwood for investors with less than $1 million and Beaconsfield for those with bigger budgets.

Buyer’s agent or DIY?

Naturally, Skinner and Lee suggest that investors will find it easier to navigate an interstate property market and achieve a better result using an expert such as themselves. But using a buyer’s agent is also recommended by Allen, who sits on the other side of the transaction.

He says interstate investors in Perth should “100 per cent” use a buyer’s agent, unless they are expats or very familiar with the state. “WA stands for ‘wait awhile’ – it’s a big country town and if you’re not from here, it’s a bit of a different world.” Allen says a buyer’s agent can help to “navigate local regulations and nuances, and potentially get you access to off-market opportunities”.

Lee says the value a buyer’s agent can provide is in the “art” of property buying, providing feedback about the street, neighbourhood and community, rather than the “science” or figures behind a property purchase. In a fast-moving property market, he adds that the relationships buyer’s agents have with selling agents play a vital role. “Properties are sold at an alarming speed at the moment,” he says of Brisbane. “Good luck trying to DIY.”

In Skinner’s experience, around a quarter of her interstate investor clients have tried to buy in Adelaide themselves before turning to her for help. “They have quickly realised that the advertised prices do not equate to property values”, a quirk of the Adelaide market that makes buying “very challenging” for the unfamiliar.

Brisbane buyer’s agent Colin Lee helped Alex De Muelenaere buy this investment property in Brisbane’s Thornlands.

Devil in the details

Variations in the sales process between different jurisdictions is a key risk unassisted buyers also face, and yet another reason why tapping into local expertise can be useful.

For example, in Adelaide once an offer has been accepted and a property goes under contract, there is typically a cooling-off period of two business days, during which time buyers will get a building and pest inspection and have the sale contract reviewed, Skinner says. “Only after your cooling-off period has expired do you actually make your deposit payment. So it’s a very different process to other states, and it is one that many clients get a little bit confused by.” She adds that while 10 per cent may be the standard deposit, the amount paid is more often a figure agreed on by vendor and purchaser.

“The purchase process in Perth shares similarities with other Australian cities but with local nuances,” Allen says. For example, while offers are often made subject to finance approval and a building inspection, there is no mandatory cooling-off period in Western Australia. “A lot of people from the eastern states say ‘we’ll pop an offer in’. Well, if your offer’s accepted, subject to finance, that’s it. We’re locked in. You can’t ring me four days later and say ‘oh, we’ve had more of a think about it, and it’s all too hard’,” he says.

In Brisbane, offers are usually made subject to a finance approval and building inspection period of 14 days, Lee says, with a nominal deposit of a few thousand dollars payable on the acceptance of an offer, followed by a more typical 5 per cent deposit amount when the offer becomes unconditional. “Sydney and Melbourne are quite different markets altogether. They’re way too hot for any seller to allow for a subject to finance and subject to building and pest offer. You’d have to typically do all of that prior.”

To visit or not to visit?

Opinions are divided on whether it’s essential to visit the location where you’re considering buying. “Many investors purchase sight unseen, relying on comprehensive virtual tours, local contacts like real estate agents and buyer’s agents, and detailed building and pest inspections to make informed decisions,” Allen says.

But Lee cautions that it can be dangerous to rely upon photos or videos provided by the seller’s agent. “They work for the seller, so of course they are only going to sell the good bits.” He recommends his clients visit before making an offer on a property, but in a fast-moving market being able to visit at short notice will be required.

“The majority [of our clients] would have never seen their investment,” Skinner says. While this is not problematic in the case of investors using a buyer’s agent, she adds that if a buyer doesn’t have someone on the ground who can inspect the property on their behalf, they could be opening themselves up to a huge amount of risk.

“It’s astounding how many people will put offers in sight unseen and not get a building inspection either,” Skinner says. “We might look at the same house, and it would not even be something we would recommend to our clients because the photos are very different to what you’re seeing in person.”

Katherine Skinner, director of National Property Buyers, says investors risk an expensive mistake if they don’t inspect an interstate property before buying.

Managing from afar

Once purchased, managing an interstate investment property needs on-the-ground support, Skinner says. “It would be a very dangerous game trying to manage from interstate yourself and not understanding the legislation here in South Australia in terms of tenancies.” Allen says a local property management company and a good handyman are essential. “Staying informed about local market conditions is crucial for long-distance investment success,” he adds.

Lee suggests investors get three rental appraisals on their property from local letting agents and ask them questions such as how much experience they have, how many properties they’re managing, what their fees are, how often they conduct inspections and how they assess the applications of prospective tenants.

Top tips for buying an investment property interstate

Seek the assistance of a buyer’s agent or on-the-ground expertise.

Set clear investment goals to narrow down and pinpoint locations.

Be aware of differences in the buying process between states.

Inspect the property either personally or by using a trusted proxy.

Engage a local property manager to avoid falling foul of tenancy laws.

Link for FULL ARTICLE here.

! 📰💼 🙌💪 #FeaturedInAFR #SmartInvestor #Grateful”

Recent Posts