Investment Tips

Property: the young investor’s safest path to wealth

Times are challenging – I get that. There are myriad recent event causing discomfort and anxiety in all facets of our lives.

But it’s all now playing on the minds of young investors, and the trepidation is damaging their financial futures.

If you’re a young investor keen to start building long-term wealth, but feel anxious at present, you’re not alone.

However, the solution is not to hide away – in fact, real estate is delivering an excellent opportunity right now if you can push past the alarmist headlines. You just need to pause, take a breath and think in a practical way about what property investment can deliver.

Here’s why I believe real estate is the ideal vehicle for young investors in today’s market.

Leverage is your friend

Many of the young investors I talk to are attracted to ‘in vogue’ assets.

They’ve heard about NFT’s and crypto. Even shares seem sexy to this generation. They’ve been told (mostly by ‘social influencers’) they only need to invest a little bit of money to enjoy huge returns.

To them property is scary because you must invest several hundred thousand dollars buying a home or unit. It makes these investors anxious to see the ‘big price tag’, so many decide real estate isn’t for them.

But dig below the headline numbers, and you’ll discover the truth.

Firstly, when buying property, you aren’t expected to come up with the whole purchase price from your own wallet. You’re often borrowing 80 to 90 per cent of the funds – and this delivers you a huge wealth-building advantage.

Let me give an example. If you have good financials and stable employment, you could purchase a $500,000 investment property for as little as $50,000 deposit (sometimes less).

You’re now leveraging bank money (good debt) to build your wealth, because you generate returns on the whole property value, not just the funds (deposit) you contributed.

So, your $500,000 investment might deliver a total return via capital gains and rent of, say 10 per cent a year ($50,000 in year one). And the money to do that is costing you, perhaps, three per cent interest on $450,000 borrowed, or $13,500 per year.

That means you’re ahead by $36,500 by the end of year one… not bad.

Essentially, if you’re earning more from the borrowed funds than they cost you in interest, you’re ahead. The reason the potential borrowing is so high is banks know Australian residential property is a low-risk option with excellent long-term potential, so they’re happy to lend against it.

Property is the only investment you can leverage to this degree. With things risky things like NFTs and crypto you’re using your own money. You could only buy $50,000 worth of those investments and never get the advantage of leveraging.

Rising interest rates

Many young investors fear rising interest rates at present, but I think we should put these in perspective.

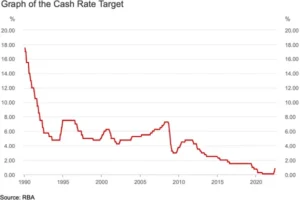

Look at this Reserve Bank of Australia chart showing the cash rate since 1990:

Even if the cash rate rose to 2.5 per cent by the end of 2022 as some have predicted, it’s still among the lowest rate in the past 32 years. The interest rates we’re seeing at present remain the most affordable in recent memory – and there’s no suggestion the RBA will let them get anywhere near their historic double-digit peaks.

The asset is valuable

Young investor who are nervous about the big money involved in property investment need to remember that the asset’s value is its own safety net.

In a worst-case scenario where you needed to repay your loan early, it’s not difficult to sell the property to cover your debts. If you have purchased the right property to begin with, it’s value should more than cover any outstanding debt. Not only will you have borrowed with a buffer in place (i.e., your loan-to-value ratio) but the property is likely to have risen in value during the period you’ve owned it.

In addition, financiers are not going to simply repossess the property the day after you miss a loan repayment. Most will work with the investor to find a resolution. They will do what they can (within reason) to find an amicable arrangement.

Of course, investors with a well-planned strategy rarely find themselves in the unfortunate position of needing to sell.

Property is a long-term performer

One huge advantage young property investors have over everyone else is time.

Time in the market is a precious commodity. The longer you can hold an investment, the more it will contribute to your wealth through compound growth and rising rents.

Great property is not a high-risk venture. It’s supposed to be viewed as a long-term winner.

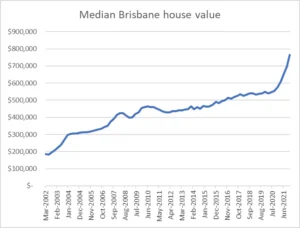

For example, have a look at this median house price chart for Brisbane based on ABS data:

Since 2002, the market value of property has increase from $185,000 to $765,000. That’s more than four-fold increase in 20 years, which is reflective of two property cycles where prices have doubled and then doubled again. More importantly, apart from a few micro shifts, the price has moved steadily upward

Alternative assets are highly volatile. Just as at the time of writing this blog, the ASX has seen its value drop 4.75 per cent in a matter of hours. Then there’s crypto – Bitcoin is down 16.3 per cent in value just today alone, and 66 per cent from its peak in November last year.

Why gamble on these sorts of rollercoasters when property delivers steadfast results?

The secret to buying well

There’s also fear around real estate at present because of falling activity and demand since interest rates rose. Sydney and Melbourne in particular are reporting far fewer sales and less buyer interest.

But markets are more complex than the statistics would indicate. They can be defined by locations, property type and price point. The performance of an established $500,000 home in a mid-ring Brisbane suburb will be vastly different to a one-bedroom $1 million apartment in inner Sydney.

The old saying that you make your money in property when you buy, not when you sell has never been truer. If you buy the right property, in the right place, for the right amount and at the right time then you will do well.

Conversely you might buy a dud property type in an area that lacks the fundamentals for long-term price growth and rental demand. You might also buy at a time when you can’t afford to, and the economics don’t work out. Worst of all, you might overpay. Do all this and the results can be financial underperformance at best, or fiscal ruin at worst.

The key is choosing the best possible property for your budget, financial arrangements and risk profile – and that’s achieved via the professional guidance of an expert and mentor.

Australian residential property can deliver substantial wealth in a sustainable, reliable fashion over the long term. By relying on tried-and-true fundamentals you can select an asset that will see continued demand from both renters and buyers for years to come.

Recent Posts