Investment Tips

How Much Super Do You Really Need Today?

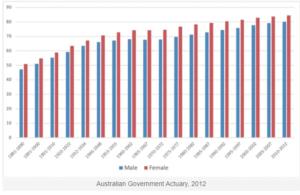

The great news is that we are living longer than ever before. The chart below shows the male and female life expectancy progression, from the 1800’s to the 2000’s. I came across this graph from the Australian Government Actuary, 2012 (this is their last study) which shows that since the 1800’s, our life expectancy has increased from late 40’s, early 50’s to now well and truly into the late 70’s and mid 80’s.

The reality is that we are now living longer due to advancement in our healthcare and aged care services, we are better nourished (some may argue otherwise) and live healthier lifestyles (again some may argue otherwise). The fact is we are living longer on average and that means we must “survive” and thrive longer on the financial resources we have in our savings and superannuation fund.

Average life expectancy in Australia right now is now at 82.5 years (according to the Australian Institute of Health and Welfare), which is above the OECD average of 80.6 years. Gotta love Australia – we get clean air, fresh food and we live a fairly balance, stress free life. Maybe that’s why we are living a little longer.

The bad news though is that we would need more financial resources in our retirement age – time when you can withdraw your superannuation funds. If we are living to 82.5 years, and the official retirement age according to the ATO is 65, we will have another nearly 20 years of living to do!

According to the Australian Government Actuary (AGA) and the Centre of Excellence in Population Ageing Research (CEPAR), it estimates that one in eight for a babies born in 2014 will live to the ripe age of over 100. Over the past 20 years, the number of people aged 85 years and over has increased by a whopping 125.1%

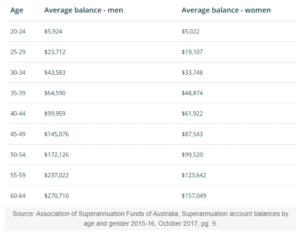

According to The Association of Superannuation Funds of Australia (ASFA) – Super account balance , it quotes “many people will still retire with inadequate superannuation savings to fund the lifestyle they want in retirement” and that “most people retiring in the next few years will rely partially or substantially on the Age Pension for some or all of their retirement as they have inadequate super savings”.

The ASFA retirement standard estimates singles will need retirement savings of $545,000 for a comfortable retirement, while couples will need combined retirement savings of $640,000.

The very bad news is that we are no where close as a society, the chart below shows that the average super for men is at $270,710, for women at $157,049, we are far from what is required to retire comfortably. We are at a crisis point, where a significant majority of our population will have to depend on the aged pension to survive, let alone thrive. Most people will have to work beyond 65 and well into their late 70’s just to make ends meet.

I use a really good resource to calculate if my super is on target and check in where I am with my current super and contributions to see if that would fund my lifestyle income upon retirement.

Did you know that the Age Pension was introduced in Australia in 1909. Back then, Australia’s population of 4.3 million people had an average life expectancy of just 55 years. Only a very small minority of our population reached the Age Pension age of 65 for men and 60 for women. See the pension rates in the table below, bearing in mind that this is the full pension rates possible, not withstanding the Income and Asset test, which would decrease the pension rates.

Based on this, to live on the age pension, as a single, you would be looking at an annualised “income” of $24,268 whilst a couple would be earning $36,582 per year. I would suggest that this is hardly enough to live comfortably at all with the current cost of living in Australia. This is an interesting article on the differences in cost of living in Australia’s capital cities.

It would be worth you looking at what the gap is – how much super do you currently have and what super you would require to retire. As the saying goes, prevention is better than cure.

So if you know you have a gap, it is much easier to do something about it sooner rather than later. A good rule of thumb is to have around 15 to 20 times your annualised cost of living in your super by the age of retirement.

This is of course dependent on a range and raft of factors, including cost of living, mortgage repayments, rent, dependants, travel, bills, medical costs and emergency funds. Bear in mind that inflation is to be factored in at CPI value.

I would suggest that you decide or at the very least, know how much you would need or want to live on upon retirement and work backwards. Beginning with the end in mind. Then figure out a strategy to get yourself ready and make head way. Should you require more information on this, we can assist you to tabulate the amounts you need for retirement and put a plan for property investment as an option for you to build wealth for your retirement.

It is far better to pay the price now and make the sacrifice, put in the extra work and make wiser investment choices, than to “suffer” and pay later. Short term pain for longer term gain.

Recent Posts